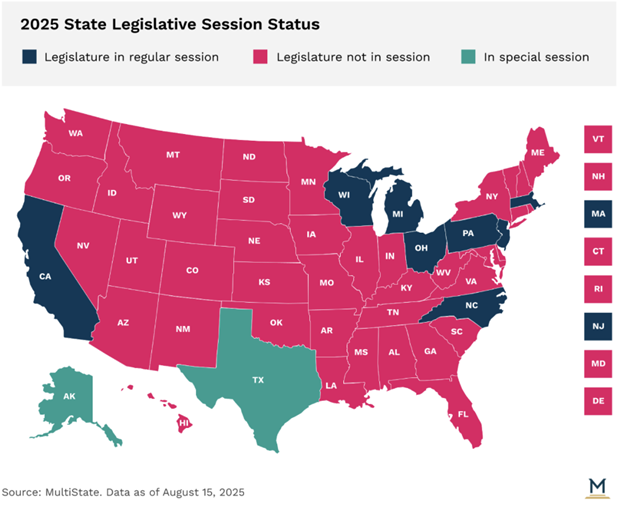

While federal lawmakers are taking their August recess before getting back to work next week, the majority of state legislatures have already adjourned for the year. Only eight states are still in session: California, Massachusetts, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, and Wisconsin. In addition, the Texas legislature is currently in a special session. Lawmakers in the rest of the states have gone back to their home districts and will not consider any more legislation until 2025, unless a special session is called.

Despite short sessions, legislators were hard at work this year pushing through a large number of bills in just a few months. States introduced more than 135,500 bills in 2025 so far – an increase of approximately 55 percent from the 87,500 bills introduced in 2024. Out of those 135,000 bills, nearly 29,000 bills were signed into law and enacted. In comparison, the U.S. Congress has introduced just over 10,000 bills in 2025.

Throughout the year, AEM has traveled to state capitals across the U.S., meeting with state legislators to discuss policies that will strengthen and grow the equipment manufacturing industry. Since January, AEM has helped pass a number of beneficial bills at the state level, while also working to stop bills that would have a negative impact on our industry.

Here is a closer look at key wins in the Midwest region so far this year:

Illinois

Illinois was considering a number of bills this session regarding PFAS, synthetic chemicals that can be found in a variety of applications impacting the non-road equipment sector. HB 2954 would create a PFAS fund to be financed partly through an unspecified PFAS tax on manufacturers. Additionally, HB 1295 would require manufacturers to submit detailed information to the Illinois Environmental Protection Agency (EPA), including product descriptions, the purpose of PFAS use, and the amount of each PFAS present, while also banning the sale of any product containing intentionally added PFAS. Both of these bills were defeated in favor of passing HB 2516, a bill that does not affect equipment manufacturing. The bill bans PFAS in cookware, cosmetics, dental floss, juvenile products, menstrual products, intimate apparel, or food packaging.

Wisconsin

Lawmakers in Wisconsin introduced AEM-endorsed legislation to create a Dairy Cattle Innovation Fund, which will make new technologies and equipment increasingly available to more Wisconsin dairy farmers through zero interest loans. The FY2025-2027 budget also included $20 million to fund the program. With the help of the Dairy Cattle Innovation Fund, dairy farmers will be able to access critical financial resources that can lead to cost improvements and increased efficiency through the usage of modern dairy technology.

Indiana

Property tax was the priority issue for legislators this year in Indiana. Governor Braun signed SEA 1 into law, which included important changes to property tax law. The legislation raises the minimum threshold for filing business property taxes from $80,000 to $2 million, phased in over a couple of years. It also eliminates the 30% floor on Business Personal Property (BPP) depreciation for newly purchased property. These changes will alleviate the tax burden on businesses with personal property holdings.

Iowa

State lawmakers in Iowa introduced a bill that outlines a comprehensive framework for implementing battery stewardship plans in Iowa. SSB1196 aimed to enhance the collection, recycling, and management of batteries. It mandated that by January 1, 2028, producers and retailers can only sell or distribute covered batteries or battery-containing products if they operate under an approved battery stewardship plan. These plans were required to include detailed information on performance goals, consumer awareness strategies, collection site safety, and funding methods. There would be a fee of $100,000 imposed on battery stewardship organizations upon plan approval, with annual fees thereafter, to be deposited into a newly established battery stewardship account within the groundwater protection fund. The bill was passed out of the Appropriation subcommittee, but it was defeated before moving out of the House.